Commercial real estate investing - The ultimate guide

Investing in real estate, whether residential or commercial, offers ample opportunities to investors. They can build wealth, save for retirement, achieve financial freedom and what not.

Among several options, CRE, or Commercial Real Estate Investment, is the finest real estate investment choice for people wishing to earn passive income with the potential for significant long-term returns.

It is a high-risk, high-reward asset class that includes a variety of property types you've probably never considered investing in before.

What is commercial real estate (CRE)?

In simple words, Commercial real estate is a property where people do business.

You can also think of commercial real estate as a property having at least five or more units utilized only for commercial or income-generating purposes.

It includes retail premises, workplaces, assembly plants, warehouses, hotels, motels, theme parks, quarries, hospitals, and airports.

The tenants for commercial properties are businesses and corporations. Commercial properties may be subject to more complicated zoning rules than residential ones, depending on their location.

Why invest in commercial real estate?

There are many reasons why you might want to invest in CRE. Some of the most common reasons include:

- To generate passive income - Commercial property markets can be a great way to produce steady monthly or annual income through rents or leases.

- To hedge against inflation - As prices for goods and services increase over time, buying commercial properties can help protect your portfolio from inflationary pressures.

- To diversify your investment portfolio - Diversification is basically when an investor is spreading wealth across various markets. CRE offers 4 ways to diversify your portfolio - asset class, location, property type, and transaction sponsor.

Here's a quick-start property development course that you should not miss (especially when it is FREE😉). This Free online course helps you to get started with property development and steps to achieve success in it.

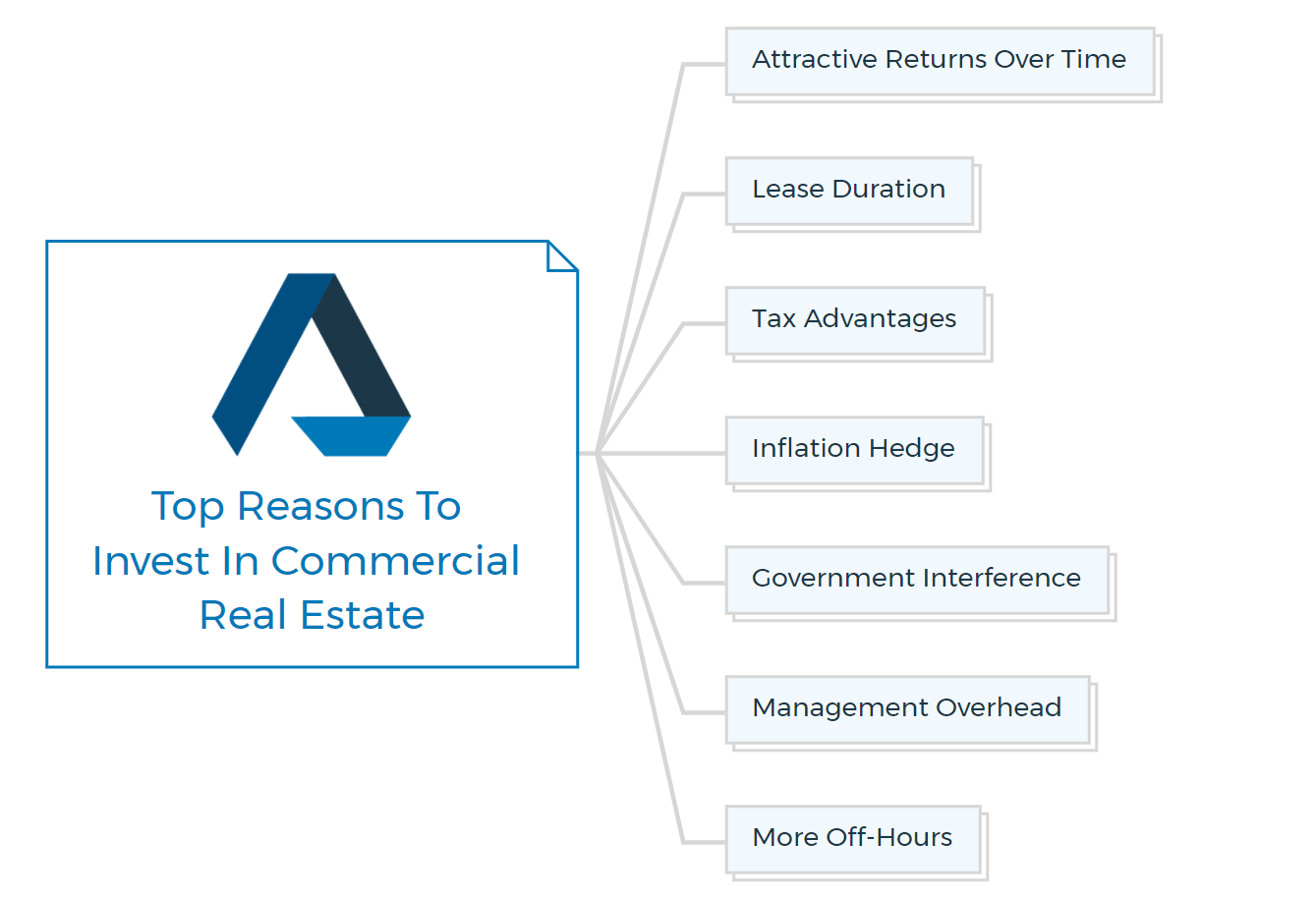

Reasons for investing in CRE

Attractive returns over time

Most investors recognize that it is best to hold an asset for an extended period rather than trade in and out in search of profits. Commercial Real Estate can deliver substantial, predictable returns in this regard.

Commercial real estate investors frequently enjoy consistent cash flow from their investments, with income paid out annually, quarterly, or even monthly. This is because high occupancies and predictable rents often provide the consistent cash flow that most investors seek.

Annual returns in CRE range from 6% to 12%, compared to 1% to 4% for residential properties.

Lease Duration

Commercial real estate leases are typically much longer than residential leases, which gives investors the potential for stability and predictability in their income stream.

Longer lease terms also give commercial tenants more flexibility to make changes to their space to suit their business needs, without worrying about potentially having to move if their landlord decides not to renew their lease.

Tax Advantages

Commercial real estate is subject to tax credits that can cut the tax burden on the property significantly.

There are several options for reducing or eliminating capital gains. If you buy properties in good locations, they should increase in value over time. However, you can depreciate the value of the structures over time for tax reasons, lowering your annual taxable income.

You can also avoid capital gains taxes when you eventually sell your property, thanks to 1031 exchanges. You'll need to "swap" those gains for another property or item when doing so.

Deductions for mortgage interest, depreciation, and non-mortgage expenses, including upkeep, repairs, and association fees, are all possible when investing in commercial real estate.

Not good in math? Are you concerned about your tax and financial calculations? Get the property development feasibility software and calculate your numbers in no time.

Inflation hedge

Commercial real estate has the advantage of being able to offset the long-term impact of inflation. The fact that property rentals can be adjusted with inflation, which is frequently the outcome of robust economic growth, is a crucial influence.

This is different from assets such as stocks and bonds, which might experience decreased returns due to inflation.

Government Interference

There is not much interference by the government in CRE as compared to residential real estate.

If a commercial tenant fails to pay his rent, the landlord has the same recourse ability as a car leasing firm dealing with non-payment. This is one of the main reasons why many property developers opt for commercial real estate investment.

Management Overhead

When compared to residential real estate, the management overhead of commercial real estate is negligible. To be sure, commercial real estate ownership necessitates some management. Keep track of when leases are up for renewal and when rent reviews are due.

You'll need mechanisms in place to keep the properties in good repair, deal with unforeseen events, verify rentals are paid and pay your own costs, such as property taxes.

More off-hours

Don't get confused with my words - Commercial Real Estate requires a lot of work. By more off-hours refers to the number of hours spent talking to tenants. In comparison to residential real estate, these hours are minimal in commercial real estate.

In commercial real estate, most of your tenants will be following the typical 9-5 schedule. It usually entails extra "time off," this way; you will be away from your phone and enjoy more personal time.

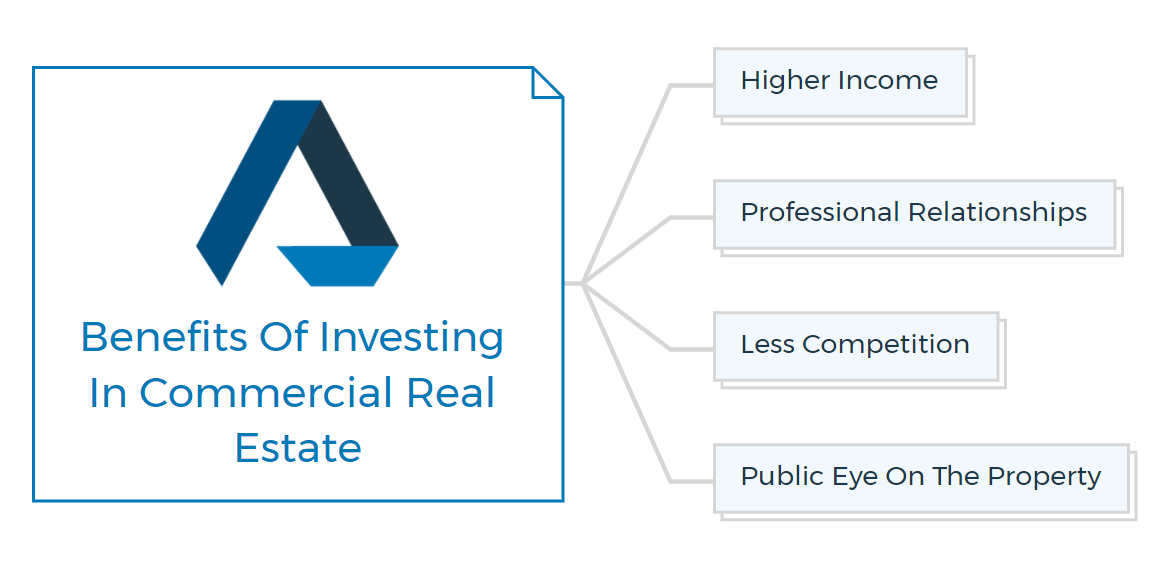

Benefits of investing in commercial real estate

As you saw, there are many good reasons to invest in commercial real estate. Commercial real estate investing can be both personally and financially rewarding.

Many people engage in commercial real estate for future prosperity and stability, while others do so for tax benefits and to diversify their investment portfolios.

Commercial developers can also benefit from the following advantages:

Higher Income

The primary benefit of investing in commercial real estate is the higher potential income. In general, CRE can provide better ROI, on an average of 6-12%.

Second, because properties tend to have more units, commercial real estate has a more negligible vacancy risk.

Also, as explained above, Commercial leases are often lengthier than those seen in residential real estate. This means that commercial property owners will experience significantly less tenant turnover.

Professional relationships

Many small business owners are proud of their businesses and want to protect their livelihood. Commercial property owners are usually limited liability companies (LLCs) or special purpose vehicles like discretionary and unit trusts that manage the property as a company.

This allows landlords and renters to have more business-to-business connections, which helps in maintaining professional and friendly contacts.

Less Competition

Another benefit of commercial real estate is that there is less competition. The business space is less saturated with other investors due to the perceived difficulties of commercial investing.

Public eye on the property

The general public is watching the property. Retail tenants have a vested interest in keeping their store and storefront in good condition because it will harm their business if they don't.

As a result, the interests of commercial tenants and property owners are aligned, allowing the owner to maintain and increase the property's quality, and hence the value of their investment.

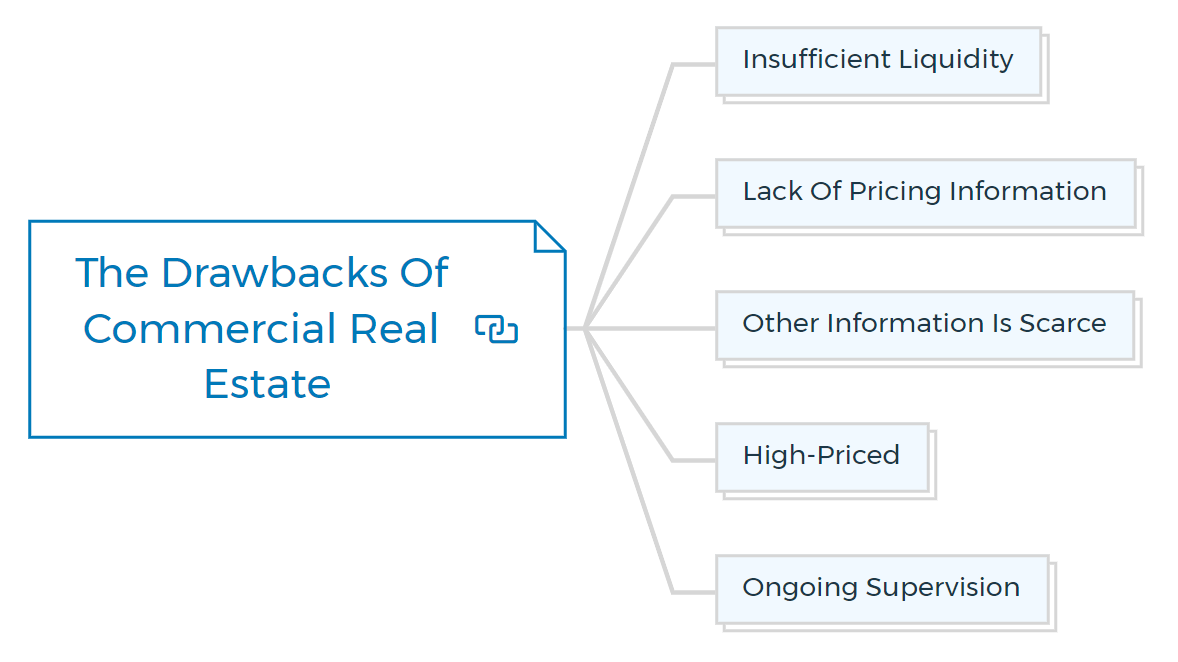

The drawbacks of commercial real estate

Commercial property is not for everyone, and no investment is risk-free. The following are some potential drawbacks in this industry:

Insufficient liquidity

Property trust shares are widely available for purchase and sale. It is not the case with most other commercial real estate transactions.

Property syndicates are usually for at least five years, and to sell a holding is difficult unless you can locate a buyer yourself.

One can sell a direct property investment, but it will take several months and incur the usual selling charges, much like a home. It could be a problem if there is a severe economic crisis, and you need to sell a specific commercial property.

When it comes to stocks, you may sell at a loss. However, in the case of commercial property, it may entail months of work or even no purchasers at all.

Lack of pricing information

Your newspaper publishes stock prices every day. Prices for managed funds are also readily available. You will often find each suburb's average property prices in the newspapers' real estate sections.

However, aside from sales announced in the daily newspapers, there is little cost information available for commercial real estate developers.

So, unless you own a property trust, you have no data of a particular property in the market and the increase in its value.

For this reason, the Property Council of Australia created its commercial property investment performance index, which measures income, capital gain, sale, and total return. Based on billions worth of property, it has become a benchmark for several investors.

Other information is scarce

Take an interest in the stock markets; you will find an abundance of investor information—far more than you can consume. Magazines, books, newspaper supplements, seminars, training courses, websites, stockbroking newsletters and reports, and so on are only a few examples.

Even the residential real estate sector is well-covered, with books, at least one magazine, and regular media appearances.

However, except for a few articles and breaking reports on listed property trusts, there is little guidance for commercial property investors. Several real estate agencies strive to educate potential investors with books and websites.

The fact is that, as a newcomer to the commercial property market, you will have a difficult time finding enough published data to help you distinguish between a good and wrong investment property.

High-price

If you merely have a few thousand dollars to invest in commercial property, listed property trusts are likely to be your best option. Property syndicates generally require a minimum investment amount, usually at least $10,000.

You won't be able to get into direct property investment with less than $100,000, and you'll almost certainly need much more. In contrast, you can start little (about $500) with the stock market and progressively increase your investment.

Ongoing supervision

Direct property investment may necessitate your continued participation in the property. You'll have to maintain the property yourself unless you hire professional commercial property management.

Market trends must be kept in mind. For example, if you own an office building, the owners of adjoining workplaces may be rewiring their buildings with high-speed telecommunications cabling. If the tenant leaves, your property may become less appealing until you follow the same.

Furthermore, even while lease arrangements provide significant security, they cannot prevent a tenant from falling insolvent. That's when the tenant's bank guarantee (or bond) comes in handy.

Overall, if you're just getting started in commercial real estate, it can appear to be pretty tricky. And many of the market's professionals are content for it to remain a secret to all except the most privileged few.

As a result, this article aims to assist in 'lifting the veil' on these commercial real estate insider secrets. Enroll on one of my structured property development courses and achieve ultimate success in property development.

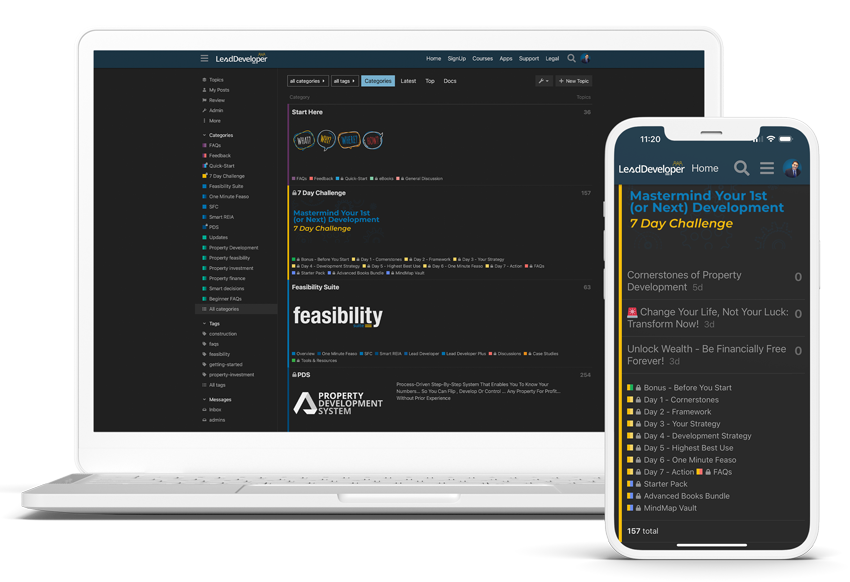

Mastermind Your 1st (or Next) Development

7 Day Challenge

This 7 Day Mastermind Challenge is not just a course. It includes my step-by-step, decision-making frameworks, my go to feasibility tool to vet projects in under One Minute & actionable mind maps showing you my property development process, and property selection strategies.

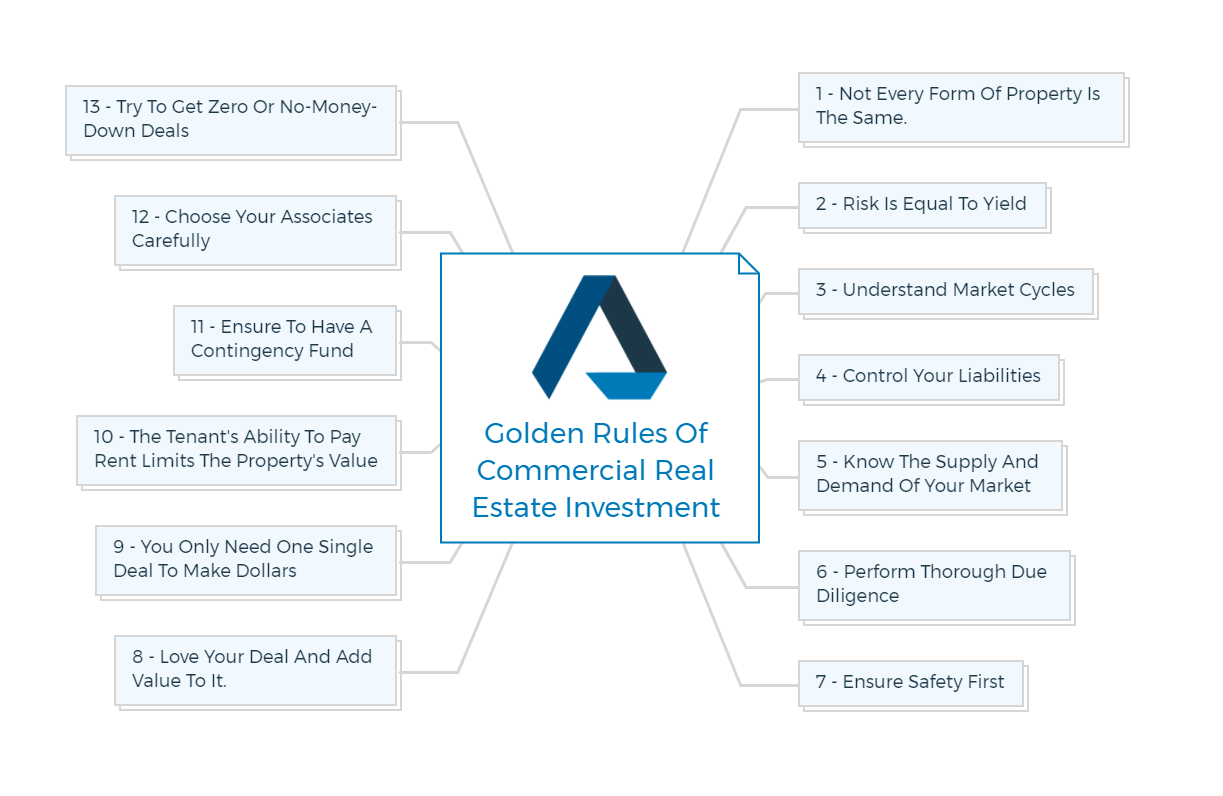

13 golden rules of commercial real estate investment

Rule 1 - Not every form of property is the same

There are several different asset kinds in commercial real estate. While commercial real estate is traditionally divided into five categories: industrial, office, retail, multifamily, and particular purpose, there are numerous other property types to consider, including self-storage, medical, elder care, land, and hotels.

Each sector's market forces, return, and net profits are all different. Based on availability and demand in the asset's specific area, some properties do better than others.

Even on a macro level, though, some industries outperform others. In today's environment, it's critical to understand how to pick the asset types that are most profitable or offer the best potential.

No matter which asset type you are selecting, get yourself acquainted with property developer FAQs if you want to achieve ultimate success in each of your real estate projects. You will find answers to all your questions.

As per the current trend, we can say that industrial CRE asset is one of the best performing classes while retail space is the lowest-performing commercial real estate asset.

With the rise of online shopping, retail stores find it difficult to compete, resulting in lower returns and slower growth.

Keep in mind that some commercial real estate sectors have more vacancy rates since they may only have one tenant, such as an industrial warehouse or a single office space.

To reduce the potential risk, some property developers and real estate investors choose properties that contain multiple tenants.

Rule 2 - Risk is equal to yield

You might have heard this before - the higher the risk, the better the reward. Similar to this, we can't deny that the lower the cap rate, the lesser the risk.

In other words, the market capitalizes on rental revenue with a low cap rate for a low-risk investment (i.e., a large factor). A high cap rate (small factor) would be applied to the income from a risky property.

As a result, the goal isn't necessarily to find the property with the highest return, but rather the property that offers a good balance of risk and rewards appropriate (and lucrative) for your situation.

If you find a property that has a low risk (low market cap rates) yet a high return, you've found the deal of the century.

Rule 3 - Understand market cycles

The profitability of commercial real estate is directly related to the economy's health, unemployment rate, and GDP. All these are the parts of the commercial market cycle which you should know.

Understanding what precisely the market cycle is and how it works is highly beneficial for you.

This commercial real estate investment rule will assist you to avoid purchasing at a high price and having to sell at a low price. Furthermore, understanding sure market cycle signs can aid in determining what possibilities are available right now and making more informed investing selections.

Rule 4 - Control Your Liabilities

Liabilities are just assets in hiding.

While it has been seen that people have huge control over their assets and not on liabilities, the Golden Rule of Commercial Real Estate Investment says that property developers or real estate investors must have some control over their liabilities.

In some places of the World, it is nearly impossible to fix the mortgage interest rate for more than a few years. Ensure to fix your interest rate if you find any such opportunity.

One of the significant advantages of the US real estate market over many other nations is securing fixed-rate mortgages, even 30-year mortgages.

In my career in property development, I have met a lot of property investors who choose not to fix the rate. For saving a minimal amount (0.5% lower interest rate), they get fooled by the interest rates touching roofs in the future.

It's a blunder perpetrated not only by legions of typically rational investors but also by armies of mortgage brokers who, no doubt, make more money on loans that turn out to be more profitable for the banks.

I advise all my students to avoid providing personal guarantees on any real estate loan. There are two reasons behind avoiding personal guarantees in the loan.

First and foremost, a real estate investment should be self-sufficient. The risk of having a personal guarantee is that it could be called up, forcing you to repay the principal on a loan taken out by a limited-liability company. Of course, signing a personal guarantee dismantles this liability barrier.

The second reason is that banks will frequently ask for a list of your contingent liabilities or liabilities that may fall on your shoulders when applying for future loans. The longer this list becomes, the more reluctant a bank will be to offer you money.

Rule 5 - Know the supply and demand of your market

One of the most crucial things to keep in mind when investing in commercial real estate is that each market is unique. You're putting money into a specific geographic area with its supply and demand dynamics when you invest.

Certain property kinds may be doing well on a macro level, yet you may find an oversupply in your city or vice versa. Investors frequently fail to undertake sufficient market research to identify whether there is a risk of market saturation.

Researching the market supply in your surrounding area is a great place to start, considering both the present rentable square footage and any new square footage that will add due to current activity and planned developments.

If you've found an undersupplied property type in your market, you can undertake a feasibility study to determine the sector's future growth potential and the chance of success.

My structured property development courses will provide you with all of the knowledge you'll need to succeed in the property investment and development process. Not only you will reveal my secret success strategies, but you'll also get a taste of real estate's practicality with these courses.

Rule 6 - Perform thorough due diligence

A prospective buyer's due diligence period is when he or she can perform extensive research on an investment possibility.

This can entail looking over the former owner's financials, records, tax returns, profit and loss statements, and doing surveys, property inspections, a feasibility study, or any other research required.

Don't forget to look over the 26-question Property Development Due Diligence Checklist, which will help you lower your risk. Many of my students request this checklist to ensure a smooth and error-free property development project.

You can trust and make this checklist part of your own due diligence process as they are mine too.

It is quite common for new real estate investors to become so enthralled by the prospect of purchasing their first commercial property that they overlook something important during their due diligence.

You will minimize potentially costly mistakes if you have a strong awareness of what needs to be studied, properly examined, and inspected before you buy.

Rule 7 - Ensure Safety First

The Safe Way Is The Only Way!

Mind my words here. Whether you're new to property development or have a lot of expertise, making sure your projects are safe should always be your top focus.

Return on capital or return of capital: which is more important? What good is a 25 percent annual return if the investment fails after two and a half years? Make sure your money is secure.

It includes obtaining adequate property insurance to ensure that your assets are protected in the event of an earthquake, fire, or another natural disaster.

Developing and investing in real estate entails several hazards. As a real estate developer, you should know various real estate development risks and ways to manage them.

Rule 8 - Love your deal and add value to it

One of the most common mistakes investors make when purchasing or investing in real estate is falling in love with the property. When it comes to commercial real estate, the tenant and the lease are usually the most critical factors.

The house could be useless without a renter – or it could be a fantastic opportunity. It is entirely dependent on your level of education and experience.

You'll have to wait for inflation to raise the value of your rentals and, consequently, the capital value if you acquire a wholly leased commercial property at a fair market price.

Alternatively, suppose you acquire property with some vacant space, below-market rents, unused rooftops, unleashed storage space, and various other attributes that you can do something with.

In that case, you may swiftly swap your ideas, thoughts, energy, and passion for significant sections of capital value. Ultimately, it is you who plays a critical role in the real estate you buy.

Rule 9 - You only need one single deal to make dollars

You can make a million excuses, or you can make a million dollars.

A serious property developer will opt for making million dollars. But what does it take to earn handsome money? JUST A SINGLE DEAL!

Commercial real estate isn't always about numbers, where the more properties you purchase, the better your chances of becoming financially independent.

Two deals are better than one. Focus on one commercial property and manage it well rather than juggle five different projects and barely track who owes how much rent.

Mastermind your first and subsequent property development and create your successful property development strategy.

Rule 10 - The tenant's ability to pay rent limits the property's value

This commercial real estate development rule defines the cap rate differently. If you can't find a tenant for a building, it won't be worth anything, and no bank will offer you money to buy or refinance it.

Your capacity to build a portfolio, as well as the value of that portfolio, is contingent on your ability to find steady, long-term tenants.

More specifically, the value of a building is not solely determined by how much one tenant pays in rent. What if that one high-rent renter left? The worth of a building is determined by the amount of rent you can persuade any renter to pay in an acceptable amount of time.

As a result, always strive to improve the environment for current tenants—it will make them less likely to quit. It will be much easier to find replacement tenants if they do depart.

Rule 11 - Ensure you have a contingency fund

Any investment entails some level of risk. Unknown factors will always impact your overall yield, no matter how much study, verification, or preparation you do. Accounting for cost contingencies is one strategy to mitigate this risk.

You can set aside additional funds as part of your initial acquisition cost to cover unexpected expenses such as rent increases, management changes, renovations, rezones or building costs. These funds can be used to cover debt service costs until the property stabilizes.

If there is negative cash flow, cost contingencies can be very helpful. They also help to improve the property's performance. Commercial real estate has a standard contingency budget of 5%-15%. However, this will depend on the asset and sub-performing properties.

Rule 12 - Choose your associates carefully

Even if you have a great team of lawyers, real estate agents, accountants and private detectives, crooks are hard to beat. Even if you win the case and get what you believe you owe, the scammers may have taken something else.

Not to mention the time and effort you spent dealing with them in the first place and cleaning up afterwards.

Only one solution is available: Work with ethical people. Although you may not make as much money quickly, it will last longer, and you will feel happier about it.

The most significant advantage of dealing with ethical people is that they are more likely to be friends with other ethical people. As you grow in your circle of friends, you will find yourself surrounded by people who are more open to fairness, kindness, compassion, and awareness.

Rule 13 - Invest in commercial real estate with no-money

Last but not least, learn how to invest in commercial real estate with no money. This last commercial real estate investment rule has transformed many developers' lives. However, very few are able to execute the no money down investment strategy.

Spend time learning how to structure deals, negotiate, run a number of projects so you can put together investment projects for yourself and your investors in a way that requires little or no money investment from your side.

If you would like to learn more about investing & developing residential and commercial real-estate with little or no money, click here.

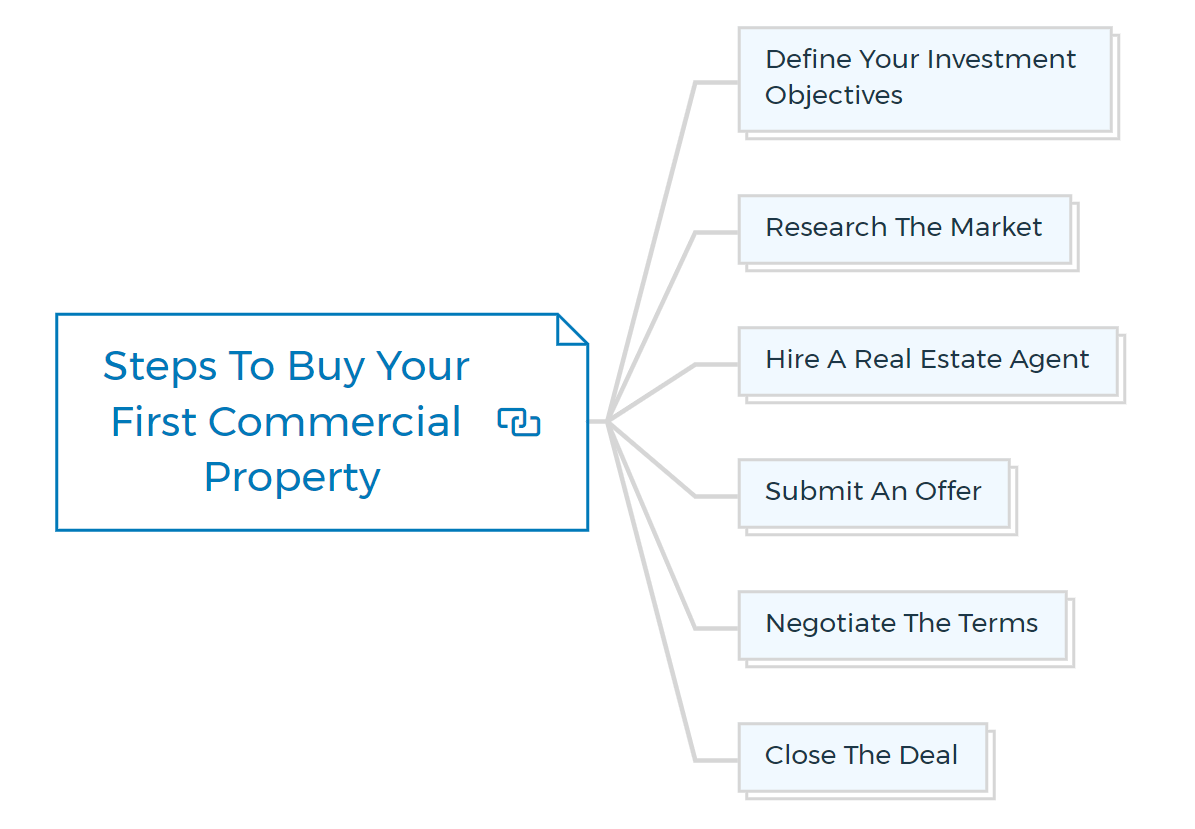

How to buy your first commercial property?

The process of buying a commercial property can be complex, so it's essential to do your homework and work with a qualified real estate agent or broker. Here are the basic steps you'll need to follow:

Define your investment objectives

What are you hoping to achieve by buying commercial properties? It will help you focus your search and narrow down the options - the later section of this blog details 8 primary property investment objectives and ways to achieve them.

Answering the following questions will help you understand what type of commercial real estate to buy and where and how?

- What is the purpose of the property?

- What is the location of the property?

- How much space does the property have?

- What is the condition of the property?

- How old is the property?

- Do you want a lucrative cash flow?

- Do you want a profitable total yield?

As an individual investor, you must determine what your primary objectives are.

- Is it to generate a positive cash flow?

- To generate a profit in the long run? It's worth noting that a high initial yield often translates to a small capital gain. The total yield is a combination of both income and capital gain.

- To be able to save money on taxes?

- To protect yourself against inflation?

You may want to accomplish all four of them, though one or two of them will likely be more significant than the others. Make sure that property is the best way to increase your wealth.

Two of your primary concerns will be to

- safeguard your first investment.

- reap a valuable, long-term benefit from it.

If these are your primary concerns, the investment options available to you are likely to be limited. That is why making a plan and sticking to it is so important.

Research the market

Get familiar with current market conditions and prices for different Commercial real estate properties. It will give you a realistic idea of what you can afford. Check out this 13 Easy Steps Real Estate market analysis blog for researching the market.

Hire a real estate agent

A good agent will have extensive knowledge of the local market and can help guide you through the buying process.

Submit an offer

When you find a commercial real estate property you're interested in, submit a written offer to the seller.

Negotiate the terms

Once the offer is accepted, you'll need to negotiate the final sale price and other transaction terms. You can seal a great deal with these 7 real estate negotiation tactics.

Close the deal

Once all of the negotiations are complete, you'll need to finalize the purchase by closing the deal.

Dos And Don'ts Of Commercial Properties Investing

Here are some "dos and don'ts" that have survived the test of time:

- Keep enough cash on hand to cover several months' worth of mortgage payments if you lose a tenant or if the tenant is late in paying. Having enough cash to satisfy any due or unplanned obligations cures investment sleeplessness faster than anything else. Keep an eye on more minor expenses as well, such as equipment and maintenance bills, as they may quickly mount up.

- Make an investing plan that you are comfortable with and stick to it—set attainable goals and work toward them. More goals have gone unachieved due to a lack of planning than a plan's failure.

- Invest in a solid financial calculator or software application like the feasibility suite and learn how to use it correctly.

- Continue your quest for education by following real estate news and laws, attending seminars, and keeping up with current trends. Knowledge can help you reduce your risks while increasing your income.

- Hire a top property consultant and a capable property lawyer, and hire means to pay for their services. To get back what you pay them, they should get you better deals than they charge you.

- If feasible, avoid personal liability on mortgages by making the property your sole security.

- Only put a modest portion of your money into speculative ventures. On the way in, they may appear dazzling, but on the way out, they are frequently painful.

- Never make a contract based on a handshake; instead, put your agreements in writing.

- Consult with your retained advisers before entering into joint ventures or partnerships.

- Avoid mortgages where there is an influence of factors outside your control on the payments. Don't take out all of your mortgages at the same time. At the very least, have a 50/50 split of fixed-rate and variable-rate mortgages.

- Don't invest in commercial real estate properties with significant negative cash flows (i.e., where your expenses far outnumber your income).

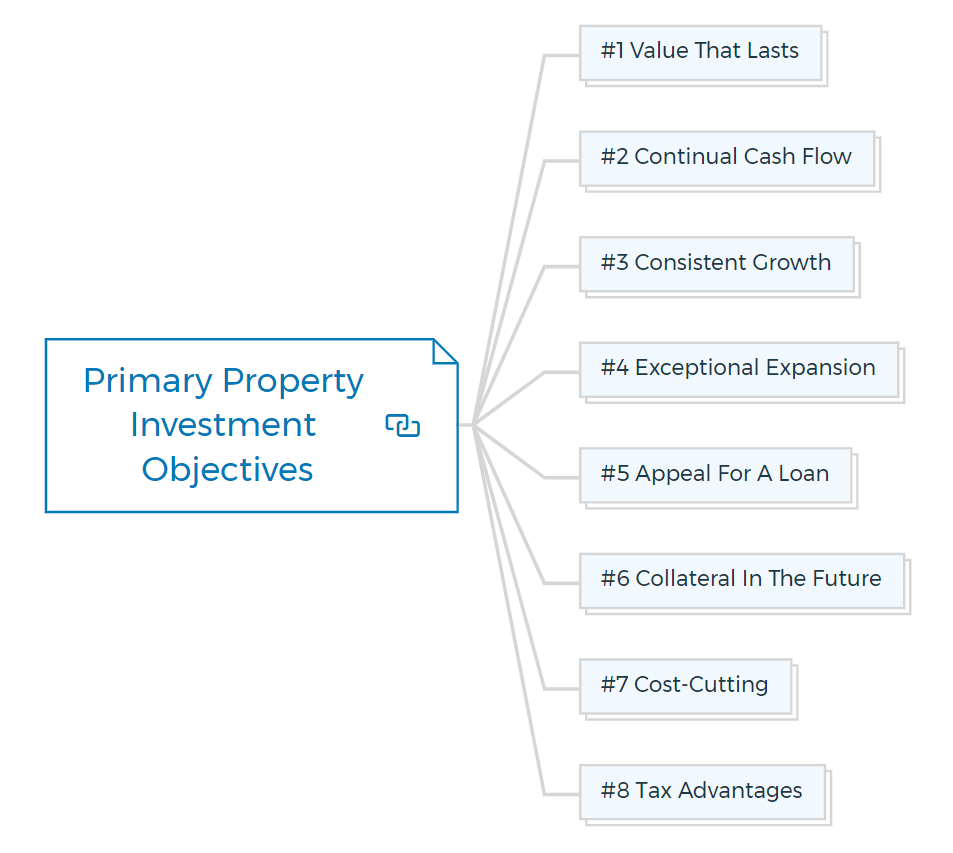

8 Primary objectives of commercial real estate investing

Now that you've worked through some 'big picture' difficulties to help you clarify your overall approach, it's time to create a list of particular goals and buying criteria. It will assist you in finding suitable commercial real estate properties within your price range.

There are eight goals for commercial real estate investing.

When developing your investment strategy, you may choose to change the particular order of significance for the following set of objectives. It's up to you to figure out how they'll fit into your overall plan. Furthermore, you are likely to have competing objectives, necessitating the development of strategies and procedures to determine how you will achieve each one. Let's look at some of the leading financial goals that have lasted the test of time. The property in question should:

- Be valuable in the long run

- Maintain a steady cash flow

- Maintain a stable rate of growth

- Encourage super-growth

- Keep the loan appeal going

- Come up with future collateral

- Provide for expense control

- Provide tax benefits.

#1 Value that lasts

If you're a long-term investor, you've probably already learned from my articles that a property's enduring value - remaining appealing even after many years and multiple tenants change.

It links with understanding current trends (both cyclical and emerging) how they will affect different property types and time frames. As a result, the enduring value should be at the top of your priority list.

#2 Continual cash flow

An investment in a prime location that does not guarantee steady income will not assist you in meeting your monthly mortgage payments. As a result, anytime you plan commercial real estate investing, you should always look beyond the first few years.

That is why it is critical to developing a marketing plan from the start. When it comes to selling or re-leasing the property, you should be able to choose from a variety of possibilities.

#3 Consistent growth

Although inflation has been under control in recent years, you should ensure that each investment provides you with consistent and predictable capital growth. The type of property will depend on the location and the anticipated market for that property at the time.

#4 Exceptional expansion

With a good consultant, you'll occasionally find investments that offer real growth potential above and beyond the market average. It can happen as a result of a clever change of use. Componentisation can result in subdivided properties.

Always be on the lookout for hidden jewels that might help you boost the total worth of your portfolio. Furthermore, as you gain a deeper understanding of the influence of your buying criteria, you'll be able to zero in on exactly which properties might provide you with this type of rapid development.

#5 Appeal for a loan

To keep your lender happy, make sure you have a steady cash flow, long leases, minor maintenance requirements, and a desirable location. It would help if you began to consider each of your potential investments from a lender's perspective. That way, you may be confident that practically every financial pitch you make will be successful.

#6 Collateral in the future

It is critical to be able to borrow money right away. To reassure your financiers and underpin your future borrowing capacity, you must also look a little further ahead to when should you consider a piece of your core portfolio as being retained for the long term.

#7 Cost-cutting

Even if your rent money is secure, you should look for properties with net leases wherever possible (where your tenant pays all the building outgoings). What is the significance of this? Because without careful management, your property's operational costs (such as rates, taxes, maintenance, and service contracts) may unexpectedly arise, affecting your overall return.

As a result, you must defend yourself on two fronts. Controlling costs is equally as effective as raising rentals to improve your bottom line.

#8 Tax advantages

You should view tax benefits as a subsidiary rather than the primary purchase motivation. There's no denying that depreciation allowances can provide significant benefits (as well as income protection).

However, if the bargain isn't viable before considering prospective tax savings, you shouldn't be acquiring it in the first place.

Key considerations when buying commercial property?

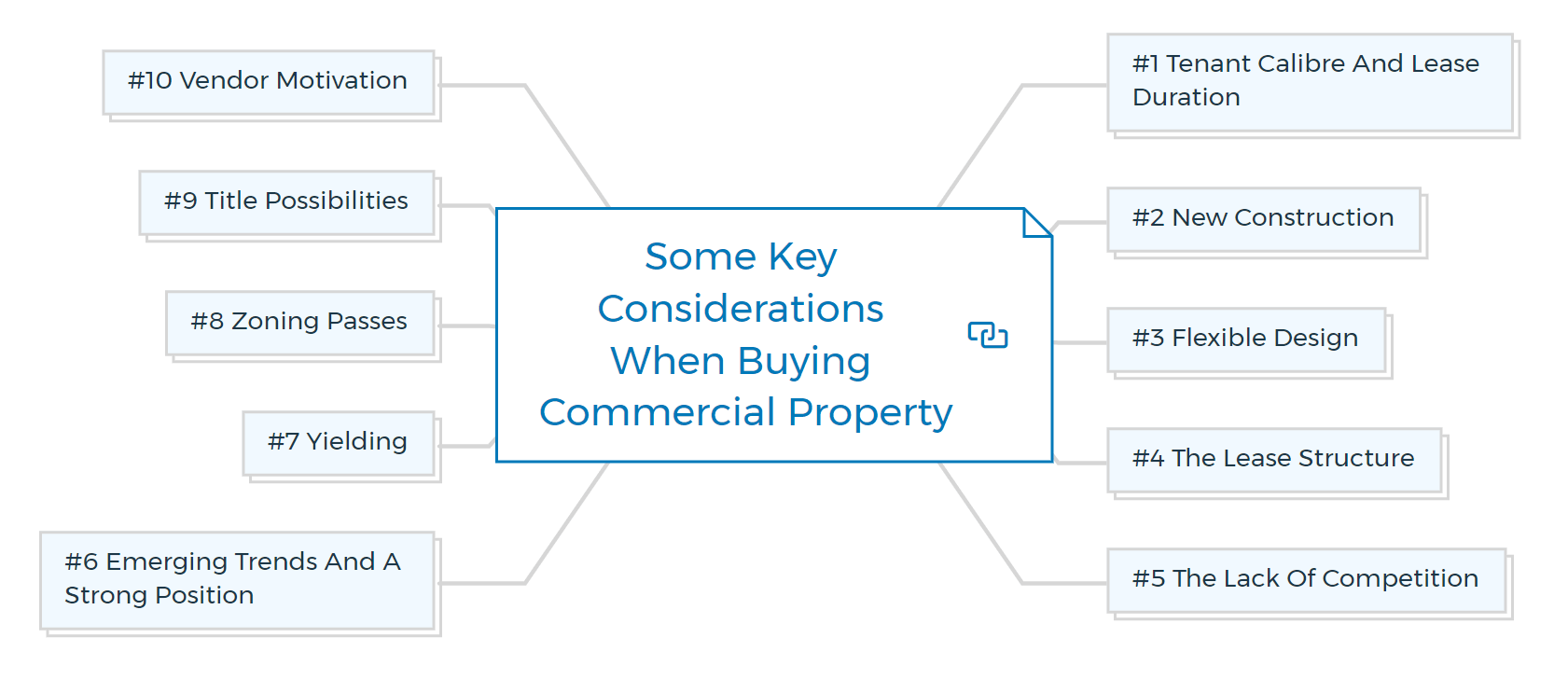

Let's take a closer look at the specific things you'll need to consider when buying commercial property. Below are 10 significant criteria for investing in commercial property.

You'll need to create specific purchase criteria to meet the investing goals discussed above. You can use these to evaluate every property investment you make. These criteria depend on their relative relevance for making sound property investments, as most investors determine over time.

#1 Tenant calibre and lease duration

The tenants' calibre and the lease length could be the most critical factors in attaining your financial goals. You're well on your way to making a successful commercial property investment if you have solid corporate (or government) multiple tenants and a minimum five-year lease term.

#2 New Construction

In general, when a commercial real estate is newly constructed, it will continue to appeal to future tenants and will require less maintenance to preserve its current aspect.

Because of this, you can achieve many of your goals, including enormous tax advantages due to generous depreciation allowances during a building's early life.

#3 Flexible design

A flexible design also means you won't be left with an inefficient floor plan if your primary tenants leave at the end of the lease period. When it comes to re-letting, you'll have an easily flexible plan that allows you to tap into a large market, along with an excellent rental income.

At that point, you can take advantage of further savings available on property taxes by depreciating any necessary renovations.

#4 The lease structure

The frequency and method of your rent reviews, who pays the operational costs, and the extent to which a tenant is liable for total building maintenance are all factors to consider when negotiating a lease. You can negotiate these elements deal-by-deal, but they affect many of your goals.

#5 The lack of competition

In the past, many commercial landlords were local investors. These days, large, national corporations have started to buy up these properties as they offer both stability and economies of scale.

The lack of competition can be a good thing for new investors, as it gives you the opportunity to get in on the ground floor and grow with the property. It also means that you're more likely to get a fair price when you're buying a property.

However, it's important to remember that the lack of competition can also lead to higher prices for properties and fewer negotiating power when it comes to leases. So while it's good to be aware of the lack of competition, don't let it dissuade you from investing in commercial real estate.

#6 Emerging trends and a strong position

If all other factors are equal, the better the location, the better the performance of your commercial real estate property. What defines a good location depends on various criteria, some of which are subjective.

The nature of the property, including factors such as visibility, public transportation accessibility, and location within a defined area, determines it for that sort of commercial property. However, as with the other criteria, you should not use this as your sole criterion.

What is the meaning of emerging trends? Demographic dynamics, such as population shifts, always lead to new investment opportunities.

New trends in building, design, energy conservation, security, elevator technology, automation, and so on are also emerging. All of these will affect the future demand for and appeal of the sites.

Taking advantage of a new trend as soon as it emerges can significantly boost the performance of any sites you already own, as well as provide you with the ability to improve underperforming properties you're looking to buy or build.

Keep looking for hidden opportunities to obtain a competitive advantage.

#7 Yielding

Passing yield refers to the current yield on an existing investment. You are unlikely to receive any increases from your market reviews if you derive it from rentals regarded as 'above market' (that is, more than the rents already being paid by tenants of similar sites).

Alternatively, suppose the rent is below market and with fixed future reviews, incremental, or tied to the Consumer Price Index. In that case, you'll be adding to (and deferring) the problem until the lease expires.

On the other hand, your passing yield may be at market rentals. It should imply that your cash flow will improve, and you may even see some exceptional growth if you spot an opportunity that many investors may have neglected.

#8 Zoning passes

Zoning refers to the current and potential uses of your commercial real estate. Your local government can provide you with zoning laws and other related information.

A 'non-conforming use permit' can sometimes be obtained, allowing residential property as an office space. While you can currently utilise it for workplaces, it may only be possible to use it for residential purposes in the future.

Suppose many of these non-conforming properties have existed in a specific neighbourhood in the past. In that case, some inner-city towns have introduced 'mixed use' zoning to legitimize (and actively encourage) the coexistence of uses.

It's something you should be aware of because specific zoning and density changes occur regularly, and if you're lucky, you can profit from them.

#9 Title possibilities

A property surveyor can tell you (for a small fee) if you can subdivide the title into a parcel of land or an entire structure, in which case you can significantly increase the marketability and thus the value of your commercial property.

You can still sell the property as a whole. Still, new buyers may be drawn in by the added flexibility of selling off a section of it if the need arises - and people are willing to pay a premium for that flexibility, which is typically well above the cost of constructing it.

#10 Vendor motivation

Although vendor motive is essential, it should not be your primary reason for purchasing a commercial real estate property. A motivated provider will invariably give you some additional fascinating perks after you've analysed all of the fundamentals and satisfied your prior standards.

These can range from leaving some money in the property at a low-interest rate on a second mortgage to allowing you to up value all of the plant and equipment so that you can depreciate it from a much higher base.

A seller may specify the written-down value of a property's plant and equipment (also known as chattels). However, the contract is frequently silent on the specific worth of these assets.

It allows you to apportion the contract price by valuing the plant and equipment at their current-day worth, resulting in a more extensive depreciation base and an immense tax advantage. This process is known as 'up valuing.'

When working with a motivated vendor, your primary focus shifts away from price to establish the most favorable contract conditions.

Summary

So, if you are looking to invest in commercial property, make sure that you ask yourself the following questions to buy a property that meets your investment objectives.

Have you determined your primary investment objective? What type of commercial real estate do you want to purchase (office space, retail plaza, industrial park etc.)? What is the length of the lease terms?

I've covered all of these questions and more in this article. But if you want to learn more or take your property investment and development skills to the next level, I suggest you enroll for my Property Development Courses.

In some weeks, you will gain an in-depth understanding of the real estate market – from finding deals and negotiating leases to maximizing your return on investment. You can confidently achieve your property investment objectives with my course under your belt.

FAQs

Is It A Good Time To Invest In Commercial Real Estate?

Absolutely, concepts like shared workplace, hot desks, 2 days office and 3 days from home get adopted on a broader scale; we will see a paradigm shift in commercial real estate. And that shift is already evident in the office workspace.

With uber concepts like cloud-kitchen and on-demand services will rise, which will, in turn, drive demand for warehousing. Most retail will move online, and office spaces will be repurposed to mixed uses.

Irrespective of this shift, human beings are social creatures at the end of the day, so commercial spaces that offer [covid compliant] entertainment, support social gathering, and provide cheaper storage or shared spaces will be in high demand.

What is the golden rule of investment?

Having a well-diversified portfolio is one of the golden laws of investing. To accomplish so, you'll need a variety of assets that will typically perform differently over time, allowing you to diversify your portfolio and lower overall risk.

What to look for when buying a commercial property?

When buying a commercial property, it's essential to consider the potential for future growth in the area and how you can use it to meet that growth. Additional considerations include:

1. Tenant calibre and lease duration

2. New Construction

3. Flexible design

4. The lease structure

5. The lack of competition

6. Emerging trends and a strong position

7. Yielding

8. Zoning passes

9. Title possibilities

10. Vendor motivation

What factors are influencing the commercial property market?

Several factors are currently influencing the commercial property market, including but not limited to: interest rates, the economy, consumer spending, inflation, supply and demand. For example, when interest rates are low, more people may invest in commercial property since it is relatively safe. And when the economy is strong, businesses may be more likely to lease or buy commercial space to expand their operations.